Divestitures, acquisitions, financial engineering

More than 200 transactions successfully completed

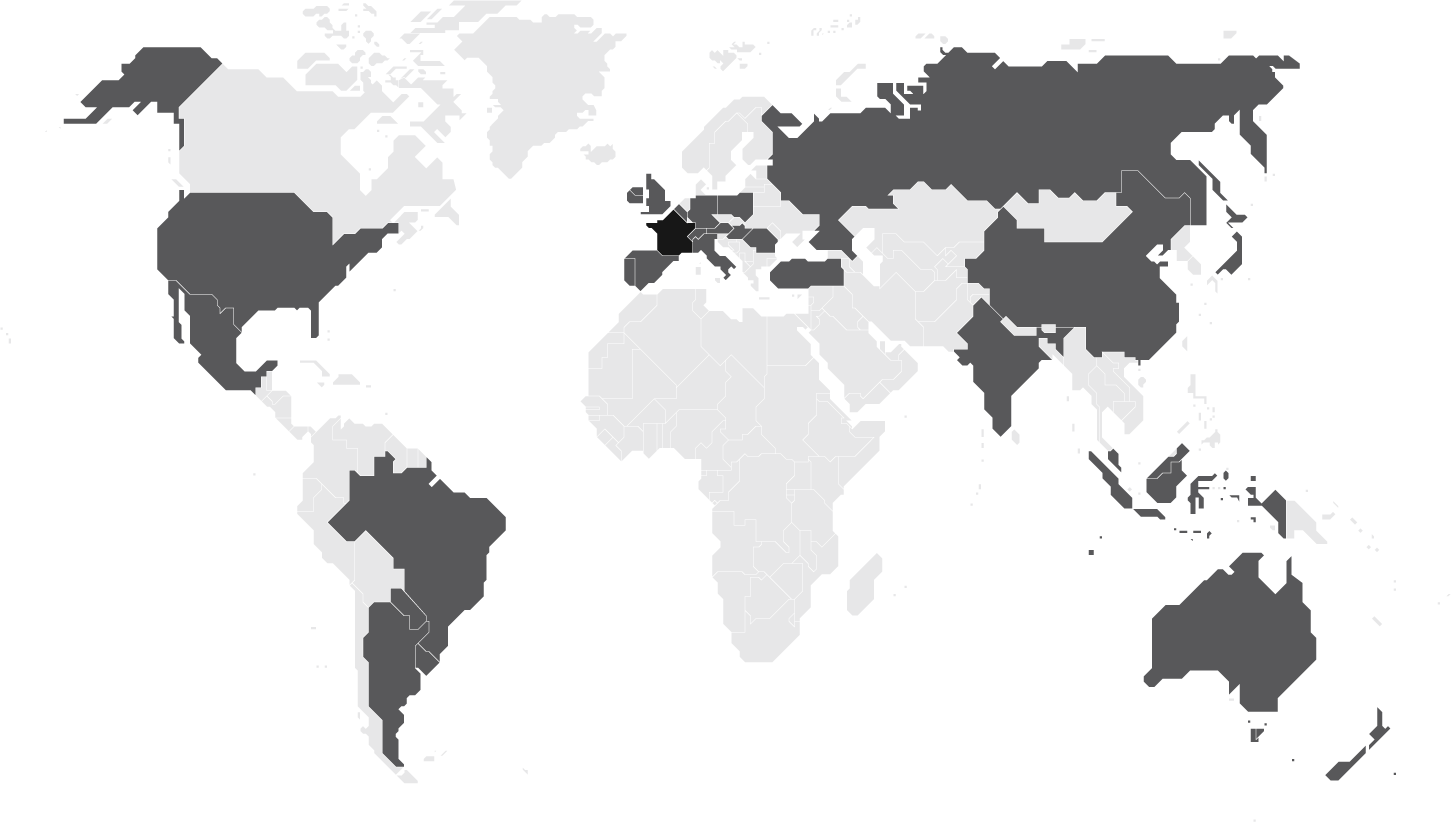

An international partner network

Business owners who value independent advice and made-to-measure solutions entrust their companies’ most critical capital transactions to our M&A practice.

Capabilities

Entrepreneurs, company leaders, private equity firms: our M&A practice serves these and other clients who come to us for expert guidance in the preparation and execution of what are often complex, confidential transactions.

The M&A team is recognized for its ability, dedication and discretion. They work directly with clients in a pro-active partnership, always responsive and fully engaged. This independent, entrepreneurial team benefits from the backing and resources of the entire Mansartis firm. Moreover, “independent” does not mean “insular”: an international network of selected banking partners enables us to cover transactions involving foreign counterparties.

M&A Practice

- Sell-side consulting

- Buy-side consulting

Financial Engineeging

- Capital restructuring

- LBO, OBO

- Refinancing

Our Difference

- Small, highly qualified team

- Corporate resources & support

- Strong client relationships

+200 Transactions

completed

acquired a minority stake

acquired

from

acquired

acquired

acquired trough an MBI

acquired

from

acquired trough a MBO

acquired

with the support of

acquired

acquired

with the support of

acquired

acquired

acquired

acquired

acquired

acquired

acquired

acquired through an MBO

acquired

acquired through an MBO

acquired through an MBO

acquired through an MBO

acquired

acquired through an MBO

acquired through an MBO

acquired

acquired

acquired through an MBO

acquired

acquired

acquired

Took a stake in

acquired

acquired

fundraised from

acquired

acquired through a MBO

and

took a stake in

acquired

Acquired

Acquired

Acquired

Acquired

took a stake in

took a stake in

Fundraising from a pool of investors

acquired through a MBO

took a majority stake in

Acquired

From

sold a minority stake in

to

took a minority stake in

Acquired

From

refinancing €217m from a banking pool

Acquired

acquired (LBO)

From

Acquired

From

Backed by

Acquired

Acquired

Acquired

From

Acquired

Acquired

&

Acquired

From

Acquired

Acquired

Acquired

Acquired

From

Acquired

Acquired

Capital reorganization

Acquired

From

Acquired

Invested in

From

financed the LMBO of

Acquired

Acquired

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

International Partner Network

Mansartis is a member of Orion International Advisors. This network of 13 trustfull investment banks covers 10 countries (USA, UK, Germany, Italy, Ireland, Australia, Japan, China, Inde…). All the members are world class M&A professionals who facilitate cross border transactions.

In addition, Mansartiss partners with a select group of independent investment banks, particularly in Switzerland (SMC Corporate Finance), Belgium, Spain and Argentina.

Team

They all share a will to succeed: tough negotiators, they are “in it to win it,” and they never waste time – especially not the client’s.

The team is composed of specialists, with an average of 15 years of M&A experience.

With their entrepreneurial outlook, they have a solid grasp of a business owner’s needs and objectives. They share a disciplined approach, a commitment to confidentiality and expertise in structuring custom solutions.

Nicolas du Rivau

Director Associate Mansartis Finance

20 years’experience in M&A and market finance. 50+ operations advised in TMT, Health and Impact sectors. Previously at In Extenso and Linkers. Paris Dauphine and Assas universities.

Arnaud Limal

Associate Mansartis Finance

35 years'experience in M&A. 100+ operations advised. Previously at Goldman Sachs, Schroders, CA-CIB and Drakestar; ESCP Europe and Harvard Business School

Thierry ROHR

Director Associate Mansartis Finance

17 years' experience in M&A. 45+ operations advised. Previously at PwC Corporate Finance. EM Lyon

Charles Billiald

Director Associate Mansartis Finance

15 years’experience in Corporate Finance. 30+ operations advised. Previously at Atout Capital and Bpifrance. Paris-Sorbonne University.

By continuing to browse this website, you accept cookies to be saved on your computer. Those cookies are used to establish visits statistics only and to improve this website’s contents. You may block cookies by configuring your browser.